ADRS Global News

DID YOU KNOW THERE IS AN ALTERNATIVE TO TREASURY'S MICRO-AUSTERITY PROPOSALS??

By Dr Asghar Adelzadeh (adelzadeh@adrs-global.com)

Published 4th September 2019

Tags:

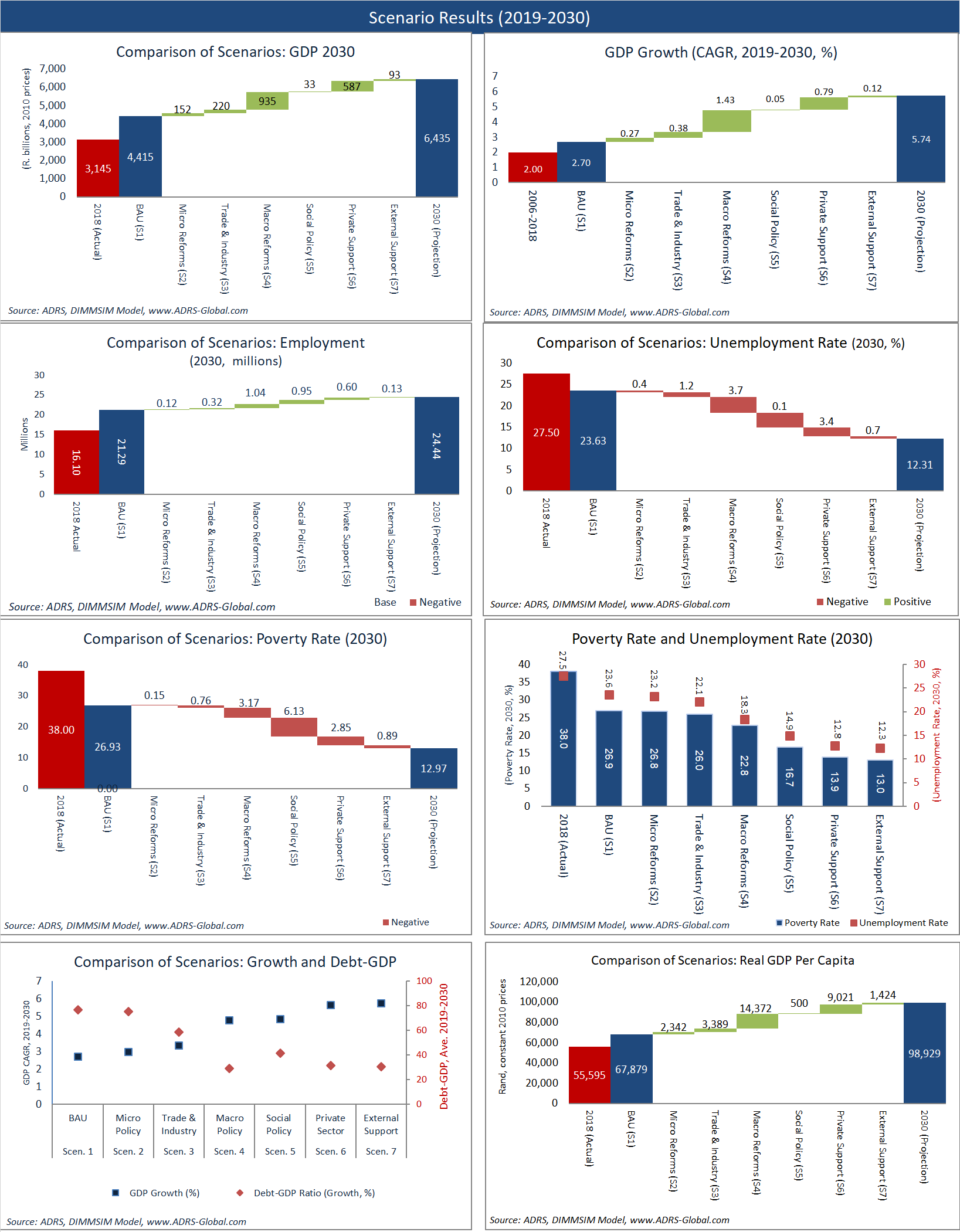

We recently completed a report on Economic Policy Scenarios for Growth and Development of South Africa: 2019-2030. The goal of the study was to identify a policy roadmap to achieve key growth and development targets that the South African government has committed to for 2030. It identifies seven economic policy interventions or scenarios for the period 2019 to 2030. With the help of the ADRS’ Dynamically Integrated Macro-Micro Simulation Model of South Africa (DIMMSIM), the likely future impacts of the scenarios have been simulated to establish the sufficiency of policy measures to closely realise the government’s key macroeconomic and developmental targets for 2030.

Policy Scenarios

Business-as-Usual Scenario (Scenario 1): The BAU scenario presents a likely outlook for the future of the South African economy that basically resembles its recent performance. According to this scenario, the future policy inputs into the economy will closely follow their most recent records. For example, through the Medium-Term Strategic Framework (MTSF) and Medium-Term Expenditure Framework (MTEF), fiscal policy will continue to prioritise lowering the debt-GDP ratio through expenditure measures, and monetary authorities will continue to use the setting of the interest rate to enforce strict adherence to the inflation targeting, with 6% as the ceiling for the inflation rate.

Microeconomic Policy Reform Scenario (Scenario 2): The Treasury’s latest report argues that adding microeconomic policy reforms to the BAU scenario will be sufficient to propel the economy on a desired higher macroeconomic performance, namely higher growth and employment path. The purpose of this scenario is to examine the extent to which Treasury’s proposed multitude of microeconomic policy measures affect the growth path of the economy. The proposed measures are in essence mainly supply-side measures for the reform of institutions and regulatory frameworks and agencies to remove the perceived “inefficiencies” and “imperfections” in the operation of the free market. The Treasury believes that this will significantly increase growth and employment in South Africa.

Trade and Industry Policy Scenario (Scenario 3): The industrial policy in South Africa utilises both supply- and demand-side measures to increase investment in the manufacturing sector and expand South African exports. The Industrial Policy Action Plan (IPAP) places strong emphasis on the manufacturing sector since the sector has relatively better spill-over effects. Even though each of IPAP’s programme and policy interventions has had some desirable quantitative and qualitative impact, the extent of its overall success in raising investment and exports of the manufacturing sector is the outcome of its multiple, inter-dependent and cross-cutting measures and programmes. Therefore, this scenario is designed to examine the extent that trade and industrial policy programme, designed to raise total investment in the manufacturing sector, expand exports, and increase the local content and procurement of locally manufactured products, helps the growth path of the economy.

Macroeconomic Policy Reform Scenario (Scenario 4): Analysis of the weak performance of the South African economy in terms of growth and employment has clear implications for macroeconomic policies. Therefore, the report considers revisiting the macroeconomic policy approach of previous scenarios. Broadly speaking, the choices are between austerity-focused and growth-oriented macroeconomic policy frameworks. The “austerity” approach, advocated by the Treasury, resorts to a sink-or-swim methodology, calls for strict austerity measures through government budget cuts of more than R300 billions over the next three years, and contends that decreasing the deficit would lower the debt-GDP ratio and create a business-friendly environment that would attract investment which in turn would grow the economy and increase employment. The “growth” approach, on the other hand, calls for growth-friendly macroeconomic policies to provide a life raft for the country as it struggles to meet growth and employment targets. It argues that increasing GDP is the preferred approach to cutting the debt relative to GDP and attracting investments.

Social Policy Scenario (Scenario 5): According to the latest Quarterly Labour Force Survey, the labour force in South Africa includes about 10 million working-age unemployed persons, using the expanded definition of unemployed. More than 60% of this group have less than secondary school education. The South African economy has been creating employment at a slow pace and increasingly for high-skilled workers. With the rising demand for skilled labour, there is little or no chance that the private sector will generate jobs for 6 million unskilled-unemployed workers in South Africa. That leaves the public sector as their last chance for employment. This scenario considers what if the government began to gradually, within 7 years, make the public works as the employer of last resort for the unskilled unemployed in South Africa, originally catering for 70% of the unskilled unemployed before expanding the service to all unskilled unemployed after 2027. Moreover, the scenario considers some adjustments to the current social security programme in South Africa, including the introduction of a grant, namely caregiver grant, for the family member that takes care of a child who receives either a child support grant or a care dependency grant.

Private Sector Support Scenario (Scenario 6): This scenario considers what if the Public-Private Growth Initiative (PPGI), which was established in early 2018, increased investments in the South African economy by R500 billion over the next 12 years, as it has proposed. The scenario also considers possible additional R100 billion investments in the South African manufacturing sector by the Public Investment Corporation (PIC). External Support Scenario (Scenario 7): This scenario considers the inclusion of macroeconomic contributions of three fairly small favourable external developments related to the gold price, growth of international import and flow of foreign direct investment. Details of the scenario are provided in the report.

Scenario Results and Findings:

The report provides details of the above policy options and their specific and combined impact on the evolution of key indicators over the next 12 years. Our key findings for the proposed policy roadmap include:

- An average growth rate of 5.74% for the period 2019–2030;

- An increase in the average investment-GDP ratio to 28%;

- A debt-GDP ratio of 30.4% by 2030;

- A reduction in the current unemployment rate by more than half to 12.3% by 2030; and

- A reduction in the current poverty rate by about two-thirds to 13% in 2030.

Please read the report for the details of each scenario and analyses of model results. Feel free to forward it to your colleagues. Please let us know if you have any comments or questions. We also warmly invite your suggestions for a scenario or policy question that you would like to see addressed in future issues.